Prime Customised Tailored car insurance loaded with our unique extras

-

Starting

from - R321pm*

- Get up to R4000 added to your Growing Accident Cover every month!

-

Accidental write-off cover

-

Theft and hijacking cover

-

Natural fire and disaster cover

-

Growing cover for smaller accidents*

-

R500,000 third-party protection

Your included benefits, unique to Prime

Included unique benefits:

24-Month Fixed Premium Guarantee

Prime’s premiums are affordable and only increase every 24 months!*

Reducing Excess

Your basic excess reduces every month you don’t claim.*

Growing Cover

“They are fast and very professional and kind. Thanks for the great service and help. .” - Bianca Hayes

See what else is included

Not just any customisable car insurance

Prime's Customised car insurance cover includes benefits you won't find anywhere else...

Cover for your car

-

Accident and write-off coverYou’re covered if you have an accident or write-off your car. Accident damage cover grows according to the plan selected.

-

Theft and hijacking coverIf your car is stolen or hijacked, you’re covered.

-

Natural fire and disaster coverIf your car is damaged or destroyed due to a naturally occurring fire or natural disaster, you’re covered.

-

Glass coverIf your car’s glass or windscreen is accidently damaged, you’re covered.

-

Hail damage coverIf your car is damaged as a result of hail fall, you’re covered for up to R20,000.

-

Third-party liability protectionEnjoy up to R500,000 liability cover if you accidentally damage another person’s car or property.

-

24-hour roadside assistRest easy knowing you’re never alone out there on the roads with our 24-Hour Roadside Assist.

-

100% market value coverFeel good knowing that you’re insured right up to the full market value of your car.

Optional extras

-

Car hireCar in for damage repairs? No problem. Get up to 30 days car hire to keep you moving!

-

Credit shortfall protectionCar stolen or written-off? Insurance paid out? Still owe the bank money? We’ve got you covered.

-

Accidental death extenderUpgrade your included Accidental Death benefit right up to the retail value of your car.

-

Tyre and rim coverCovers the cost of replacing or repairing your tyres and rims if they’re damaged by road hazards.

-

Additional driversAdd 2 additional drivers to your policy, over and above the 2 free regular drivers, for a small monthly fee.

Unique benefits you get with Prime's Custom Cover

24-Month Fixed Premium Guarantee

Prime’s premiums are affordable and only increase every 24 months!*

Reducing

Excess

Your basic excess reduces every month you don’t claim.*

Growing

Cover

Unique benefits you get with Prime's Custom Cover

24-Month Fixed Premium Guarantee

Your affordable premiums will only increase every 24 months*

Reducing Excess

If you don’t claim, your excess will reduce every month until it’s zero*

Growing Cover

With each claim-free month, you’ll get growing cover for smaller accidents up to R4000 pm. Plan dependent

Premiums quoted are risk profile dependent and are valid for 24 hours only. Accepted premiums are fixed for 24 months provided you remain claim free. A reducing excess is available on the Comprehensive and Customised cover options only. Growing accident damage cover applies to the Third-Party PLUS and Customised cover options only. T&Cs, excess charges, exclusions and limitations apply to all products.

Join us at Prime today!

We can't wait to meet you.

Looking for more car insurance options?

Browse our other Prime car insurance cover options, designed to suit every budget and lifestyle.

Prime's promise is peace of mind you can afford

Prime's promise is peace of mind you can afford

Find out what others say about us…

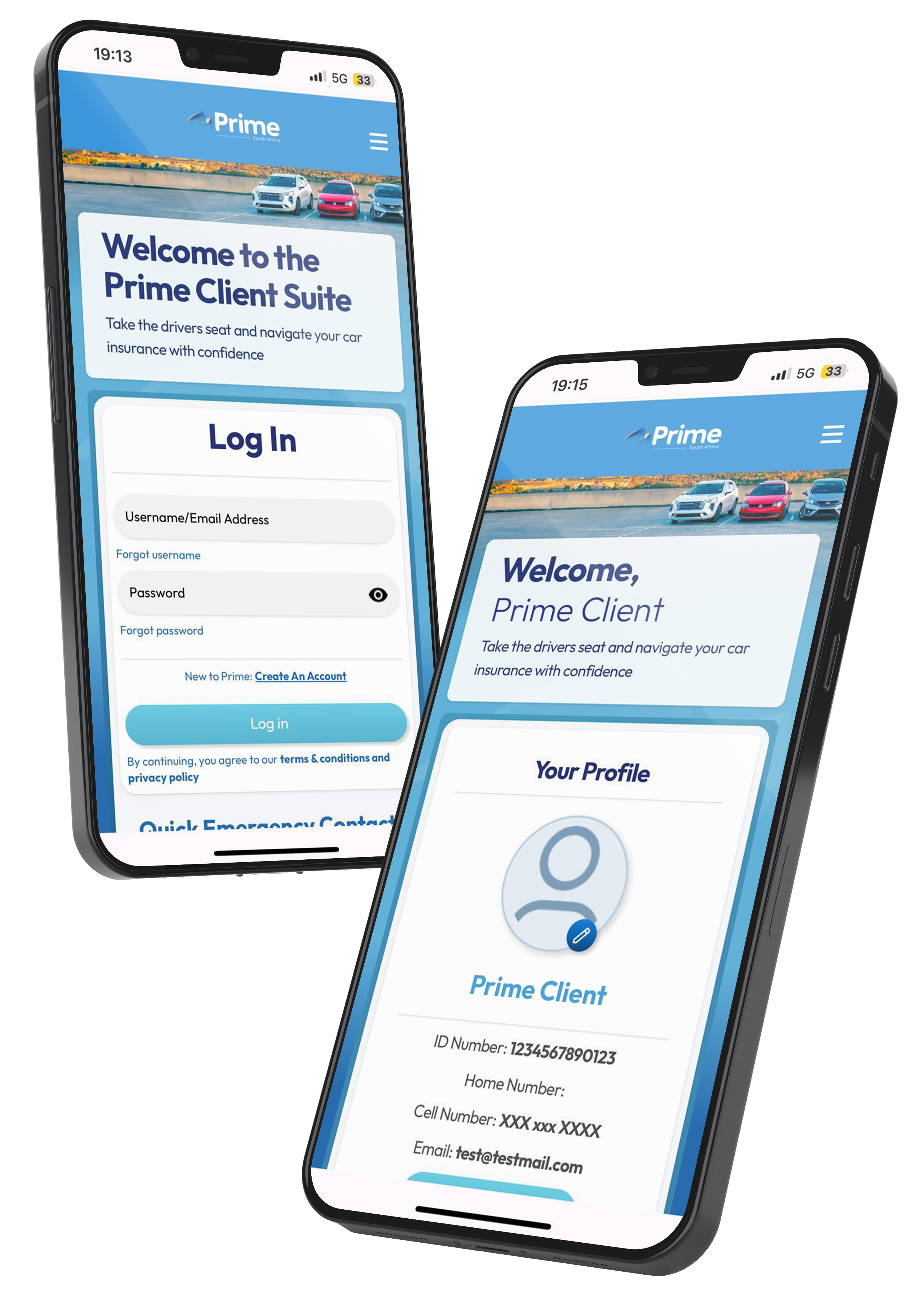

Keep Prime in your pocket

Get easy access to our services, emergency assist, claims information, policy documents, plus benefits and awards when you download the Prime app.

-

Easy step-by-step claim capture

-

You can upload your policy photos easily

-

Access to all your personal details to view or update

-

Emergency contact numbers and important information are always with you

How to find the best car insurance quotes

First establish what kind of cover you want

It’s no good asking for quotes from companies when you don’t really know or understand what you want cover for. Do you want to have comprehensive car insurance or just third party cover? By going online, find out what reputable car insurance companies are offering.2 Draw up a list of boxes that you would like to see ticked with any insurance quote. By submitting the same specifications (your driving history and requirements) to many insurers, you’ll be comparing apples with apples when it comes to their quotes.

How much excess are you prepared to pay?

The higher the excess, the lower the premium. You need to decide the maximum amount of excess you can afford to pay out should you have an accident.2

Does the quote include car hire and 24/7 roadside assistance?

Having car hire and 24/7 roadside assistance are just two examples that could be part of your cover specifications. The quote may be low, but can you afford to be without car hire, when your job totally relies on you having a car? Can you afford not to have 24/7 roadside assistance in this day and age in South Africa? ‘Yes, but I have a few friends who can tow me’, you may say. When it comes to crunch time, will they be available? The above shows how you can draw up the specifications you want to have. After that, you can start getting quotes from various companies.

It’s what is it says in the policy that counts

Many motorists just go for the lowest premium the insurer is offering. But isn’t that a bit risky? You may be paying R500 a month less on a premium, but what happens when it comes to claim time? You may discover to your horror that some items you thought were covered were actually not. By all means select a company that is offering low premiums, but closely examine their policy, to see if it covers all that you want covered. 3 Perhaps, some cover has slipped in which you don’t want, but would be paying for.

Ask the insurer to assist you in reducing your premium

You’ve found a reputable insurance company whose quote is a little outside your budget. However, the quote covers all the items you want covered. Why not sit down with the insurer and work out the best scenario to fit your budget? Perhaps you can obtain a discount by transferring say a life policy from another insurer to this one.

What if you don’t understand the policy?

Many motorists live in the fast lane, and haven’t the time to read and understand a policy’s contents, especially when it comes to the small print.2 Thus, contact a consultant, who can explain anything you don’t understand.3 For example, a policy may have a restriction of not covering your car when driving on dirt roads. Knowing this would make you avoid driving on dirt roads as much as possible.

For the best car insurance quote try Prime

Now that you have an idea of how to find the best quotes, why not contact Prime for an affordable car insurance quote? If you are satisfied, you can purchase insurance, using Prime’s Online Insurance Purchase Platform, from the comfort of your home any time that is suitable for you. If you need help, a call-back facility is available.

Disclaimer

Because car insurance is complicated, this article must only be viewed as providing information. Please consult a certified, financial advisor who can give you professional advice on any insurance aspects.